Disposable glove makers turn to nitrile to cope with Covid-19 demand

By Hyma Haridas

Industries around the world have been hit hard by the Covid-19 pandemic, with most facing unprecedented and unique challenges to their survival. The disposable gloves manufacturing industry, however, is faced with challenges of a different kind.

In the wake of the Covid-19 pandemic, the worldwide demand for disposable gloves and other personal protective equipment (PPE) has soared, leaving manufacturers struggling to keep up.

According to Technavio, the medical disposable gloves market size has the potential to grow by US$4.11 billion during 2020-2024 [1]. The report cites rising concerns over hygiene and safety from infections and the increasing preference for powder-free gloves as among the drivers of the growth for this market.

As the world’s biggest producer of rubber gloves, Malaysia contributes more than 60%of global supply. Due to the impact of Covid-19, the worldwide demand for disposable gloves is projected to rise to 330 billion gloves in 2020, with an expected annual growth of 20% and projected export revenue of US$5.1 billion (MYR21.8 billion), according to a report by the Malaysian Rubber Gloves Manufacturers Association (MARGMA) [2].

Growing demand for nitrile Because of the increasing prevalence of latex sensitivity among healthcare workers (HCWs) and patients, nitrile gloves are preferred over conventional latex gloves in medical environments [3]. At present, the production of Malaysian glove makers is largely focused on nitrile gloves (60%), which is sourced from petroleum, while latex gloves make up the balance 40% [4]. This is driven in part by the demand for nitrile gloves from the US and Europe, which are two key export markets for Malaysian glove manufacturers, as well as the low price of petroleum which helps to keep the cost of materials low.

Read: Gloves Sector: A helping hand for Malaysian gloves growth

In efforts to meet this overwhelming demand for disposable medical-grade gloves due to Covid-19 while overcoming shortage of raw materials, many Malaysian glove manufacturers have ramped up their production or diversified into producing nitrile gloves at their existing manufacturing plants.

Malaysian glove manufacturer and trader Limmas (Malaysia) Sdn. Bhd. started trading in nitrile gloves in April this year, recording a revenue of US$486 million for the period of January to November 2020. The company has also enhanced its production capacity in Malaysia by setting up its very first nitrile examination gloves manufacturing plant in Pulau Indah, valued at about US$62 million (MYR250 million).

“While some manufacturers are facing a shortage of nitrile rubber (NBR, the raw material for nitrile gloves) we have managed to secure NBR from a secure source and foresee no issues in obtaining raw material supply at a reasonable cost for the near future,” shared Lim. He foresees Limmas’ sales revenue hitting the US$1 billion mark by the end of 2021.

Superior “medical grade” gloves

Nitrile gloves are often referred to as “medical grade” and offer the same flexibility, tensile strength and durability as rubber gloves without the potential allergic reaction associated with latex. Although they are less biodegradable than latex gloves, today they are as affordable and cost-effective as latex gloves.

Additionally, nitrile gloves are three times more puncture resistant than latex gloves and provide greater resistance to blood-borne pathogens and environmental contaminants, which are highly sought-after features particularly during a global pandemic outbreak. Nitrile gloves also have three to five times more superior chemical resistance than latex gloves – making them safer to use for laboratory technicians and medical workers who regularly come in contact with hazardous or toxic substances.

“One of the unique attributes of our nitrile examination gloves is the lower co-efficient of friction. This means that they are easier to don and doff. For medical workers who have to go through numerous gloves in a day, this is crucial,” added Lim.

As a first step in showcasing its own brand of nitrileexamination gloves to the world, Limmas will be participating at the upcoming MEDICAL FAIR ASIA 2020, from 9 to 18 December 2020, which is being held digitally for the first time in its history. Limmas is one of a handful of Malaysian exhibitors to showcase its products at the regional trade fair.

Wobbly future for rubber?

According to the Malaysian Rubber Council (MRC), formerly known as Malaysian Rubber Export Promotion Council (MREPC), natural rubber made up 80 percent of total production of rubber in 2019 while synthetic rubber accounted for 20 percent of production.

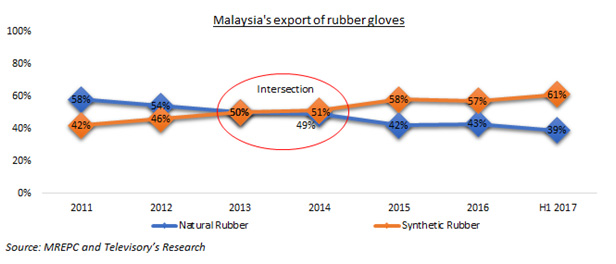

Malaysia remains the world’s leading supplier of medical gloves — examination and surgical gloves — supplying more than 50% of global demand [5]. However, based on glove exports, synthetic gloves, including nitrile gloves, first surpassed natural rubber gloves in volume in 2014.

Lim foresees nitrile gloves making up to 80% of Malaysia’s total glove production in 2020/21. He says the shift to nitrile gloves has encouraged manufacturers to set-up production facilities outside of Malaysia, including in Thailand, Vietnam, the Philippines and China.

“This could affect Malaysia’s position as the world’s biggest glove manufacturing base in the long run,” opined Lim.

However, MRC remains positive that it will achieve the export target of US$8.35 billion (MYR34 billion) by 2025 for Malaysian rubber products [6]. Latex goods remains the largest contributor to Malaysian rubber product exports, accounting for 81%of total exports of rubber products in 2019.

[1] Technavio, Medical Disposable Gloves Market by Product and Geography – Forecast and Analysis 2020-2024, Published August 2020. Accessible at: https://www.technavio.com/report/medical-disposable-gloves-market-size-industry-analysis? (last accessed: 30 November 2020)

[2] Malaysian Rubber Glove Manufacturers Association, ‘MARGMA Industry Brief 2020 on the Rubber Glove Industry’, Updated 16 July 2020. Accessible at: https://www.bursamalaysia.com/sites/5d809dcf39fba22790cad230/assets (last accessed: 2 December 2020)

[3] WHO, WHO Guidelines on Hand Hygiene in Health Care: First Global Patient Safety Challenge Clean Care is Safe Care, 2009. Accessible at: https://www.ncbi.nlm.nih.gov/books/NBK144047/ (last accessed: 1 December 2020)

[4] Surendran S and Ng J, ‘Cover Story: Diverging paths in Malaysia’s Rubber Industry’, The Edge Malaysia, published 10 September 2020. Accessible at: https://www.theedgemarkets.com/article/cover-story-diverging-paths-malaysias-rubber-industry (last accessed: 1 December 2020)

[5] Malaysian Rubber Council (MRC), ‘World Rubber Production, Consumption and Trade’, accessible at: http://www.myrubbercouncil.com/industry/malaysia_production.php (last accessed 2 December 2020)

[6] NST Business, ‘MREPC expects highest rubber trade surplus in 2019’, New Straits Times, published 10 February 2020, accessible at: https://www.nst.com.my/business/2020/02/564307/mrepc-expects-highest-rubber-trade-surplus-2019 (Last accessed: 1 December 2020).